A Cyprus ‘Foreign Interest Company’ (FIC) is an avenue that gives a Cyprus based company with non-EU shareholders the ability and priority to employ non-EU nationals instead of locals and EU nationals.

Non-EU shareholders are able to reside and set up shop in Cyprus by relocating their existing business from a non-EU country or launching a new business from scratch, whilst simultaneously hiring their key personnel from around the world and taking advantage of the island’s many benefits i.e. lifestyle, cheaper operating costs, EU membership and tax advantages – find out Why Cyprus here.

We break down the 10 advantages of a Cyprus Foreign Interest Company:

Residency, Family & Key Personnel

- Non-EU Shareholders of a FIC can apply for a business visa (work permit) and residency through employment in their Cyprus registered company. This allows any non-EU citizen to live and work freely in Cyprus for as long as the FIC is active, with them employed at the FIC.

This provides non-EU individuals or groups of individuals with the ability to relocate their existing business or launch a new business in an European Union member country.

2. Non-EU Shareholders of a FIC are also eligible and allowed to move their families to Cyprus, with their children able to attend any public or private schools available. Their spouses are also allowed to work in Cyprus.

This allows non-EU shareholders the ability to live and work freely in Cyprus without having to constantly fly back to their families. This also allows families the ability to enjoy the exquisite lifestyle of Cyprus with no concerns or worries regarding their residency.

3. A FIC can register and hire up to 5 non-EU employees as senior management, who are able to obtain a business visa (work permit), allowing them to live and work in Cyprus.

4. A FIC can register and hire up to 10 non-EU employees as middle management or other administrative, secretarial or technical staff, who are able to obtain a business visa (work permit), allowing to live and work in Cyprus.

5. All non-EU employees hired by the FIC are also eligible and allowed to move their families to Cyprus, with their children able to attend any public or private schools available.Their spouses are also allowed to work in Cyprus.

This allows all non-EU employees hired by the FIC the ability to live and work freely in Cyprus without having to constantly fly back to their families. This also allows families the ability to enjoy the exquisite lifestyle of Cyprus with no concerns or worries regarding their residency.

Additional Key Personnel (Specialists)

6. A FIC can register and hire up to 200 or even more additional non-EU employees which are considered as Specialists (e.g., tech industry, marine industry, pharmaceutical industry). The amount of additional non-Eu employees considered as Specialist that a FIC can hire, depends on the annual turnover of the company and the overall operations, and needs of the FIC.

This allows a FIC to invest further into its relocation or launch, by hiring more non-EU employees that are needed to push for growth.

Citizenship, Social Insurance & National Health System (GESY)

7. Non-EU shareholders and FIC employees, and their families, can benefit from Cyprus’ social insurance schemes and register to the Cyprus national health system for subsidized medical care.

8. Non-EU shareholders and FIC employees, and their families, are able to apply for citizenship after a period of 7 years, if they resided fully for the 7 years (more information can be provided on this)

This allows all non-EU individuals with the ability to enjoy the full benefits of being a Cypriot citizen, with a Cypriot passport, which includes all the benefits of Cyprus being a member of the European Union.

Tax Benefits – Corporate and Individual

9. Non-EU shareholders who register their companies as foreign interest can benefit both individually and corporately from Cyprus’ advantageous tax benefits (see in detail below) for companies and individuals.

10. All non-EU employees hired by the FIC can benefit individually from Cyprus’ advantageous tax benefits (see tax benefits here)

Eligibility Criteria:

Criteria that companies must meet in order to benefit from this decision, and the categories of staff and the maximum numbers of third country nationals who can be employed are all described below.

Eligibility Criteria In order to register a Cyprus company as a foreign interest company:

- Non-EU shareholder/s should own the majority of the company’s shares. (more than 50%),

- Foreign direct investment of capital amounting to at least €200.000, legally admitted to a Cyprus bank account from abroad. This amount can be used for company’s activities.

Staff Categories:

a) Senior Management – Directors, General managers, Heads of Departments, Project Managers

Maximum number of third country nationals employed: 5 persons (unless the Civil Registry and Migration Department is satisfied that the employment of a greater number is justified, depending on the circumstances of each company.)

Minimum Acceptable Gross Monthly Salary: €4.000

b) Middle Management – Upper / middle management personnel, Other administrative, secretarial or technical staff

Maximum number of third country nationals employed: 10 persons (unless the Civil Registry and Migration Department is satisfied that the employment of a greater number is justified, depending on the circumstances of each company.)

Minimum Acceptable Gross Monthly Salary: €2.000

c) Support Personnel

- A company may employ third country nationals in support positions by first securing the positive recommendation of the Department of

- A company may staff up to 30% of its total personnel with third country nationals in posts in this category.

d) Additional personnel: Exceeding the maximum allowed number of employees from third countries in each category

To employ more third country personnel, requests by the company must be submitted to the Department for approval. The requests must include information on the salary offered along with:

- The requests must include information on the salary offered as well as:

- The company’s turnover

- The ratio of third country employees to Cypriots / EU Nationals and

- The company’s operating time in

e) Specialists

Companies are entitled to employ a number non-EU nationals, up to 200 or even more, over and above the categories stated above, if they fall within the professions/skills listed below.

Minimum Acceptable Gross Monthly Salary for Specialists: €2.000.

Professions / Skills

- Software and System Engineers

- Application and Data Architects

- ICT and Enterprise Solution Architects

- Technical Assurance Professionals

- Telecom and Space Engineers

- Data scientists

- Machine Learning Engineers

- Web Developers and designers

- UX User Experience Professionals

- Quantitative Analysts

- Quality Assurance Analysts

- Mobile Application Developers

- Augmented Reality/ Virtual Reality Programmers

- Digital Marketing Specialists

- Video Production Multimedia Specialists for Mobile Apps and Software

- Analysts for Mobile Apps and Software

- Designers of Prototype for Mobile Devices

- DevOps Engineers

- Cyber Security Specialists

- Artificial Intelligence, Robotics and Big Data Specialists

- Pharmaceutical Formulation Technologists

- Pharmaceutical Engineer Validation Specialists

- Pharmaceutical Patents Specialists

- Pharmaceutical Regulatory and Quality Assurance Professionals

- Marine Engineers

- Naval Architects

Maximum number of third country nationals employed as Specialists

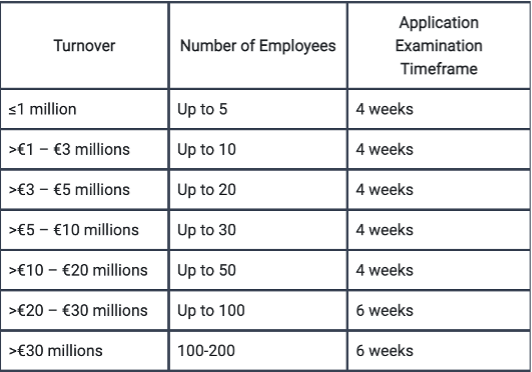

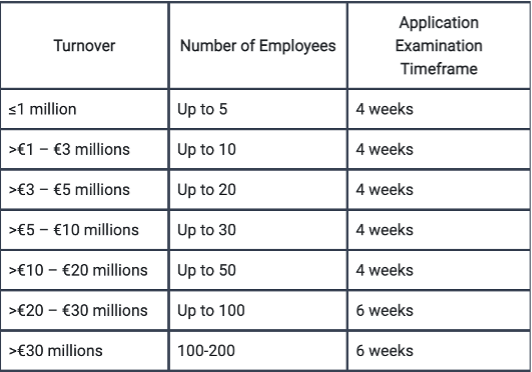

The number of non-EU Specialists allowed is based on the annual turnover of the company, as following (unless the CRMD is satisfied that a FIC requires a number higher than 200 employees):

Number of Specialists permitted based on turnover.

What we do

Panayiotis Z. Toulouras LLC provides corporate services to clients worldwide. Our law firm, with it’s team of experts, provides strategic advice for individuals and entities, seeking the foreign interest company route, and ensures a smooth transition for all clients aiming to relocate an existing business or launch a new business in Cyprus.

- Incorporation of a Cyprus company

- Registration of a Foreign Interest Company

- Business visa applications and other visas

- Launch and Setting up consultation

- Family reunification

- Employment agreements

- Purchase and/or rental of commercial and residential premises

- Applications for permanent and temporary residence

- Applications for naturalization

- IP registration

- Advice on all related tax aspects

- Opening of corporate and personal bank accounts in Cyprus and abroad

- VAT and TAX registrations

- Processing of investment and lending facilities

- Relocation assistance and advice